Corporate offences of failure to prevent the facilitation of tax evasion (“CFO”)

Background

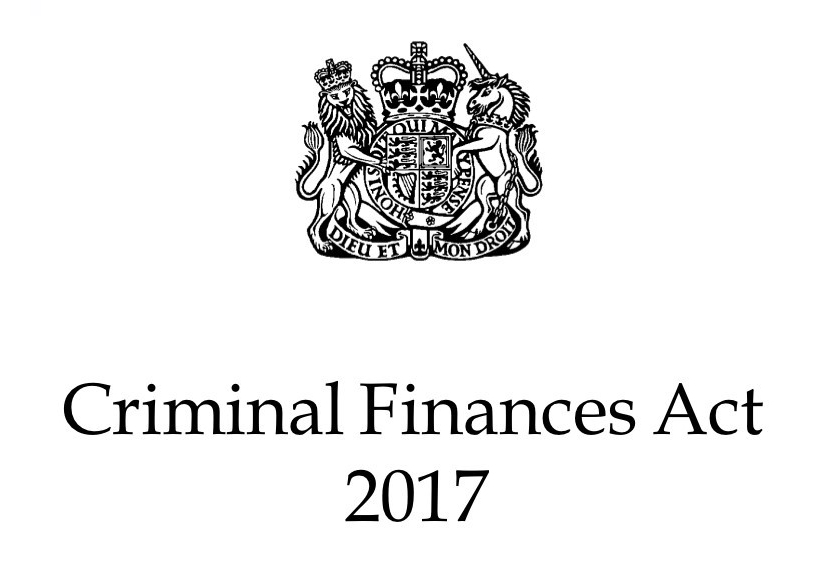

The Criminal Finances Act 2017 introduced to brand spanking new criminal offences relevant to the taxation world. These were:

- Corporate offences of failure to prevent the facilitation of tax evasion (“CFO”); and

- The new strict liability offence of offshore tax evasion

This article covers the first of these.

It is relevant to businesses involved in financial sectors or making payments where associates are involved. Where it potentially applies, such businesses should be crystal clear around the procedures that they need to put in place.

These rules could potentially apply to labour supply chains where there are bad actors involved. As such, umbrellas and recruitment agents should consider them when reviewing existing, and entering into new, business relationships.

The historical regime

There are a variety of provisions by which tax evasion (offshore or domestic) may be prosecuted. For example, the offences of ‘cheating the public revenue’ and ‘being knowingly concerned in the fraudulent evasion of tax’ are but two such offences.

However, all of these offences, like the majority of criminal offences require the Crown to prove something called the mens rea. In other words, as well as committing a particular act (the actus reus) one must also have the required intent (or, in some cases, recklessness).

Classically, therefore, tax evasion has been a crime of dishonesty

The same considerations apply to the prosecution of companies in relation to tax evasion regardless of whether they have been directly involved in the activities or whether they have simply ‘helped out’ or facilitated it.

As such, prior to the creation of the new offence, it was necessary for The Crown to:

- Prove that the ‘directing mind and will’ of the Company (the Directors) knew what was being done; and

- that they dishonestly participated in that activity (or at very least wilfully turned a blind eye to it);

The new regime

However, with effect from 30 September 2017, a new world dawned.

These new rules involved two key departures from the traditional position explained above.

Firstly, a new strict liability offence of offshore tax evasion was introduced (not discussed in this article) where there is no requirement for the prosecution to establish dishonesty.

Secondly, the new CFO offence was introduced. Here, it should be noted that the CFO rules apply regardless of whether this takes place in the UK or offshore.

The legislation (Criminal Finances Act 2017, ss44-52)

As described above, this offence has largely been introduced to counter the Crown’s problems in identifying the ‘directing mind and will’ of the Company and also proving to the criminal standard (being ‘sure’ or ‘beyond reasonable doubt’) that he or she was sufficiently proximate to the events in question.

The new offence is modelled on Bribery Act 2010, s7 so such concerns are now removed:

45 Failure to prevent facilitation of UK tax evasion offences

(1)A relevant body (B) is guilty of an offence if a person commits a UK tax evasion facilitation offence when acting in the capacity of a person associated with B.

Section 44 sets out the circumstances in which a person is associated with B:

(4)A person (P) acts in the capacity of a person associated with a relevant body (B) if P is—

(a)an employee of B who is acting in the capacity of an employee,

(b)an agent of B (other than an employee) who is acting in the capacity of an agent, or

(c)any other person who performs services for or on behalf of B who is acting in the capacity of a person performing such services.

Section 45 sets out what is meant by a UK tax evasion offence:

(4)In this Part “UK tax evasion offence” means—

(a)an offence of cheating the public revenue, or

(b)an offence under the law of any part of the United Kingdom consisting of being knowingly concerned in, or in taking steps with a view to, the fraudulent evasion of a tax.

(5)In this Part “UK tax evasion facilitation offence” means an offence under the law of any part of the United Kingdom consisting of—

(a)being knowingly concerned in, or in taking steps with a view to, the fraudulent evasion of a tax by another person,

(b)aiding, abetting, counselling or procuring the commission of a UK tax evasion offence, or

(c)being involved art and part in the commission of an offence consisting of being knowingly concerned in, or in taking steps with a view to, the fraudulent evasion of a tax.

(6)Conduct carried out with a view to the fraudulent evasion of tax by another person is not to be regarded as a UK tax evasion facilitation offence by virtue of subsection (5)(a) unless the other person has committed a UK tax evasion offence facilitated by that conduct.

It should therefore be noted that the associate must be knowingly involved in the facilitation of an offence that would constitute UK tax evasion.

At this level, the mens rea is preserved.

As such, where certain ‘associated businesses’ in the supply chain are found guilty of a tax evasion offence then another business which not taken reasonable steps to prevent it may be convicted of the new offence.

Reasonable steps defence

It should be noted that a defence is provided in s45:

(2)It is a defence for B to prove that, when the UK tax evasion facilitation offence was committed—

(a)B had in place such prevention procedures as it was reasonable in all the circumstances to expect B to have in place, or

(b)it was not reasonable in all the circumstances to expect B to have any prevention procedures in place.

Of course, whether (2)(a) is satisfied, is a subjective test.

However, HMRC has produced detailed guidance on the matter. This is important as, if one broadly follows this guidance, then one would suggest it would be difficult to be successfully prosecuted.

Summary

It is therefore imperative that businesses understand their supply chains in full and have adequate protections in place to prevent the facilitation of tax evasion offences.